- Financials

BioMar reports record results for 2023

Concluding a successful year, BioMar achieved a strong Q4, resulting in the best results ever for the group.

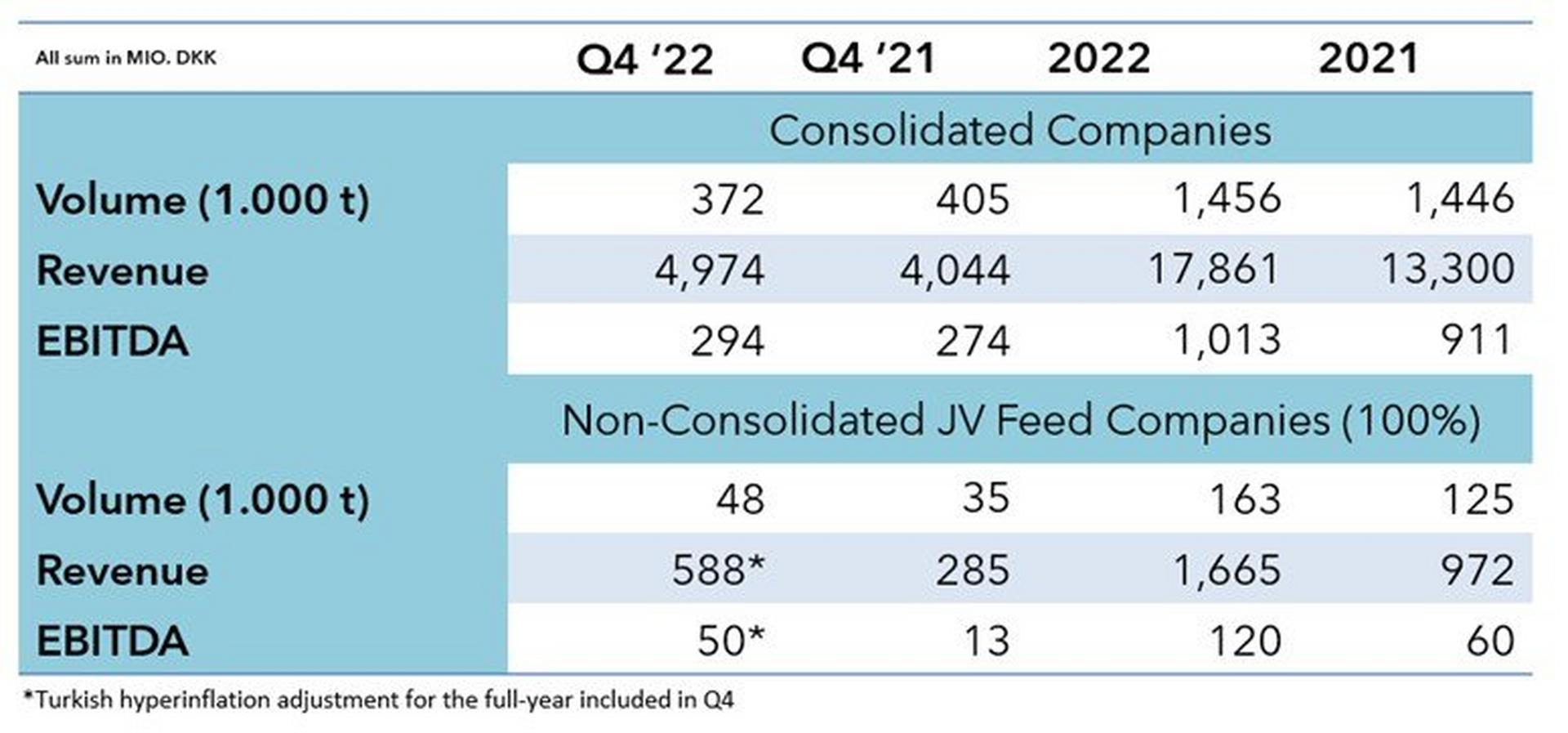

BioMar ended 2022 with a strong Q4, bringing the full year results to beat the earning guidance of DKK 1 billion EBITDA. The positive development is mainly driven by stronger development in the Salmon and LATAM divisions, compensating for a weaker result in the EMEA division.

BioMar ends the year underlining the strong growth of the company. The EBITDA of the year increased by 11% compared to 2021, while the revenue grew by 34%. On top of the consolidated results, BioMar doubles the results of the non-consolidated JV feed companies, mainly driven by the JV BioMar-Sagun in Türkiye.

“We are very satisfied with the performance of the group. We have been significantly affected by our exit from Russia and the increased raw material and energy prices, but we have managed to sustain a healthy business, continuing our growth strategy while expanding into the technology space”, explains Carlos Diaz CEO BioMar Group.

“Financially, we had a slow start of the year due to several one-offs and the impact of the global inflation. However, our people around the world have made a tremendous effort building new and creative commercial solutions through an agile collaboration with customers. Hence, we have managed to conclude the year with a decent result, despite the global volatility. We are progressing as planned, executing on our 2028+ strategy “Above and Beyond “, both in terms of growth, product offerings, and increased efficiency”, states Carlos Diaz.

Results (49)

Concluding a successful year, BioMar achieved a strong Q4, resulting in the best results ever for the group.

he year 2024 underlined the long-term positive development of BioMar. Profitability was remarkably strong in a year of declining volumes and revenue. Concluding a successful year, BioMar achieved a strong Q4, resulting in the best results ever for the group.

Following the successful entrance into the shrimp feed market, the board of BioMar approves the acquisition of AQ1 Systems, the world’s leading producer of acoustic feeding technology for the shrimp farming industry.

BioMar's third quarter reveals a decline in sales volumes year-on-year, while the company is still heading for a strong full-year result.

The investment will allow for an expansion into a new, larger facility with the capability of performing trials in semi-industrial conditions.

By adding all the feed companies in the Group managed by BioMar, including joint ventures, BioMar ends with a record first quarter of EBITDA of more than DKK 310 million.

Midyear, BioMar discloses strong momentum aiming for another all-time high full year result. While volumes and revenue for the second quarter of the year are lower than last year, EBITDA is up by 36%.

Aquaculture Stewardship Council (ASC) is thrilled to announce that BioMar UK has become the first ASC certified feed production facility the United Kingdom.

BioMar takes another important step to expand its global footprint within shrimp feed.

BioMar Australia is excited to announce a $15 million-dollar, nation-leading project to construct the first green methanol ready vessel in Australia.

Following the invasion of Ukraine, BioMar Group shuts down all trade activities with Russia. The decision includes sales of finished products as well as the sourcing of raw materials.

The significant increase in revenue in Q1 was driven by higher sales volumes, raw material prices, and to some extend currency rate development.