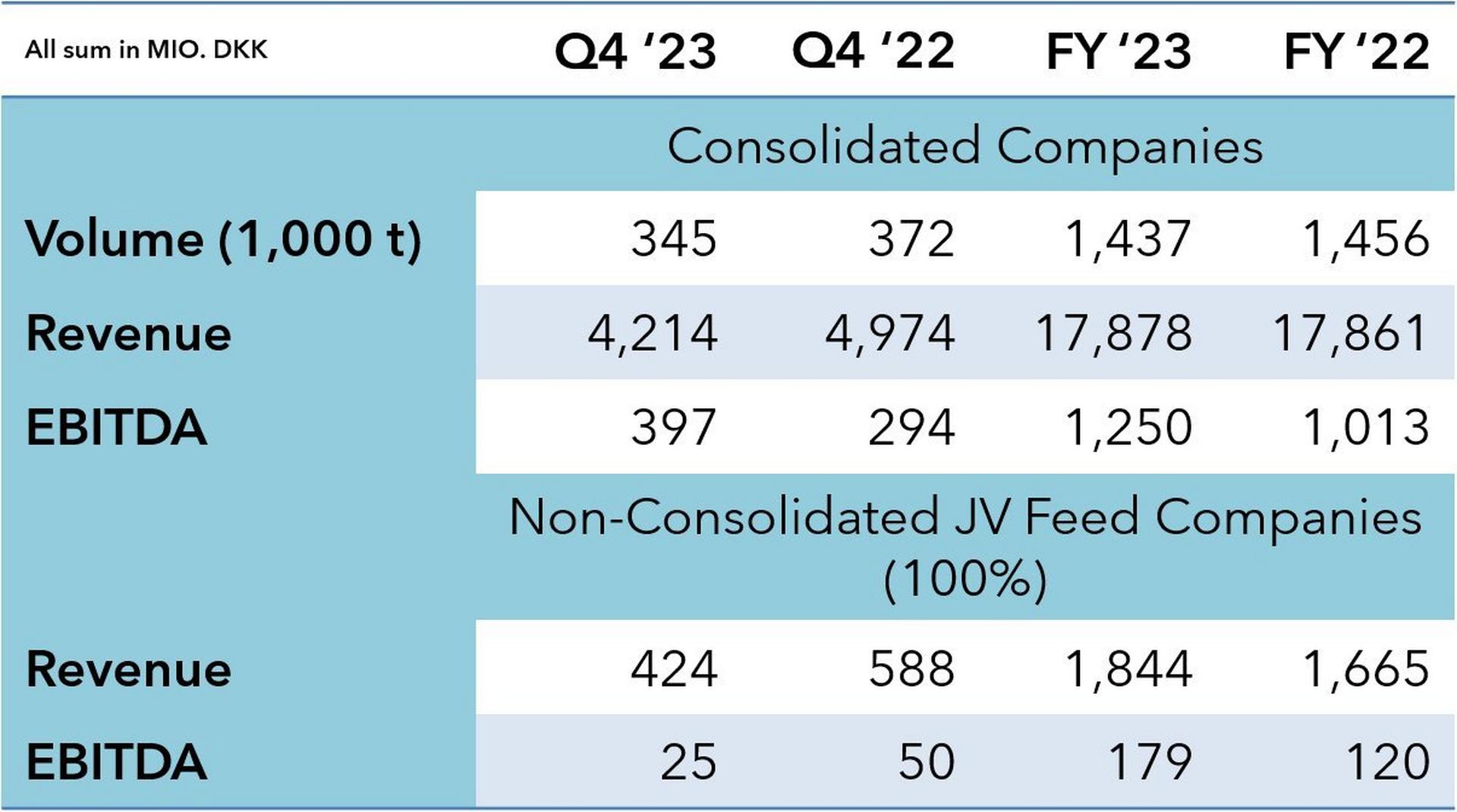

“I am extremely satisfied with our business performance for 2023. We have continued to optimise our product portfolio and product concepts, being proactive to the development in the markets. At the same time, we have improved our commercial performance both up- and downstream. Looking at the totality of our business, including our joint ventures in Turkey and China, the year summed up to a volume of 1.6 million tons, a revenue of DKK 20 billion and an EBITDA of DKK 1.4 billion” explains Carlos Diaz, CEO in BioMar Group and continues:

“The results have been driven by our efforts in positioning ourselves as value creators for customers as well as suppliers. To us, it is becoming increasingly important to create partnerships with suppliers of novel raw materials as well as forward-looking customers who believe in building long-term business relationships instead of a transactional value chain. It is only possible to change the future if we together share an ambition of a sustainable and efficient aquaculture”, explains CEO Carlos Diaz.

The revenue for 2023 ended at the same level as 2022, but on a slightly lower sales volume. The biological conditions have in some geographies been challenging; however, the development in volumes has mostly been a result of a clear commercial positioning:

“We have prioritised to build long-term product collaborations with our core customers, rather than chasing volumes. This means that our volumes have stayed stable compared to 2022. We are building a healthy business, which can further propel the development of our financial performance as well as our sustainability ambitions”, concludes Carlos Diaz.